In the last 10 years I’ve lived in 5 different countries, and traveled in many more. I’ve taught English to monks in Thailand, tagged sea turtles in Greece, au paired in the Netherlands, taught pilates to one of the King’s 13 wives in Swaziland, and 100 other things in between. A decade of adventure left with me life changing experiences, and absolutely no money. I wouldn’t change it for anything- it’s also been a hell of a lot of fun- but at least financially, that time has come. I’m about to turn 30, and my biggest dream is still a dream. I decided to change that, and that decision took some serious work.

For the last eight years, that dream has been to open my own hostel. I set about gaining the experience, and have been managing hostels for nearly 4 years now. However, one question that has always lingered was ‘How will I ever have the money??’ I’ve lived paycheck to paycheck my whole life. Any time I was able to save up money, I took it to then travel more. When that’s been your habit for 10 years, it’s pretty hard to break. So I publicly challenged myself.

For two years I had a location in the back of my head of where I wanted to open my hostel. For various reasons, I realized during a visit in December 2014 that this was not the right solution for me. I felt back at square one. It was then that I decided I may not know where in the world I was going to end up, but wherever it was I would need money. Though many people told me ‘Don’t worry about the money, the money will come, so many people have money, etc etc.’, I wasn’t ok having only sweat equity to offer. In a perfect world, this would start and remain as my project without big investment. That may not work out, but I wasn’t even giving myself the chance to try. If I wanted anyone to take my project seriously, I needed to take myself seriously first.

So, on January 1st, 2015 I made an announcement on Facebook: “Starting with a major lifestyle change: by 2016 I plan to have $10,000 saved up. I will be sacrificing drinks, eating out, dance classes, maybe my sanity, you name it. And I will gain some financial freedom to make my dreams easier to attain, wherever they may land.” I also mentioned that I find being accountable to others extremely helpful, which is why I posted this publicly on Facebook. I chose $10,000 not because I thought it was enough to open a place, but when I looked my my financial situation, that seemed the maximum I could possibly squeeze out over the next 12 months.

Turned out, I was wrong. On June 23rd, I made my final payment towards debt.

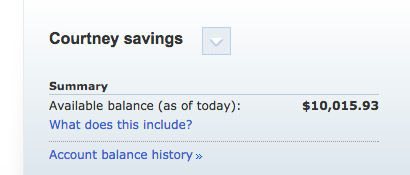

And on July 8th, I saw this:

$10,000 in 6 months, instead of 12. After years of living paycheck to paycheck...I had $10,000 of real, hard earned cash sitting in MY bank account. And my first thought was ‘How the hell did I do this?!’

I knew that others had the same question for me. Until this post, almost no one knew how close I was to my goal, but many friends knew I was working towards it (if only because I felt far less cheap saying no to everything if they knew it was for a good reason!) I would often get questions of how I was doing it: how I made a budget, how I followed it, what worked well for me.

So why am I writing this? It’s not to brag about how much money I have, though I am very proud of it. It’s because if you are anything like me, saving money or getting out of debt felt like an insurmountable task that just weighed on a little back corner of my conscious. But with a lot of determination and persistence, I discovered that didn’t have to be true.

I’m hoping by writing this and explaining how I did it, it will inspire someone out there to follow their own path to financial freedom, just knowing that it IS indeed possible. And, that it really didn’t suck that bad. I thought it’d be awful, but it’s actually been pretty amazing.

Now, a few notes first:

1) This blog post is LONG. This is simply because I wanted to be as detailed as possible for those that are looking for the how-to details. If you want the bullet point summary of how I did this, scroll to the very end.

2) This is only *my* experience, and it won’t work for everyone. I’m a firm believer in doing whatever works best for you. Hopefully this will at least inspire you to try.

3) The reason I was able to scrimp my spending down so much is a combination of craftiness, willpower, and stubbornness. Yes, we have free PB&J at the hostel, which I would often eat for lunch instead of eating out. But even if you paid for that yourself, you are saving a ton of money. Yes, we have free staff dinners, but we only have a $20/night budget. We are able to feed 6-8 people on that by buying veggies in Chinatown, buying in bulk, etc. When I traveled in Australia I was able to make a veggie & rice stir fry for $6 that would split into tupperware for 3 meals. You can do all this too.

4) If I do have to spend money, I have figured out the best ways to do it. Take transport for example. If you use your Clipper card (electronic pass) on buses in SF, you automatically only get 90 minutes. However if you pay in cash, they give you a paper ticket that is good until whenever they tore it of. They almost always give you a ticket with 3 or 4 hours. If I know I am going to be making my return trip in 4 hours or less, I make sure to pay in cash. Same if I’m heading out to the bar; by 9 or 10pm they almost always give you a ticket that is good for the rest of the night. By doing this I’ve saved an extra $2. Wherever you are, whatever your situation is, you can make these small things work for you too.

5) While this hasn’t been awful, it’s also rarely been easy. For instance, one night it took me 2 hours to get home from the bar instead of 20 minutes. After refusing to take a $15 cab home in the name of savings, I took the night bus (only $2, yay!)...in the wrong direction (god d@%$#%#). Unfortunately at that point I was much further away than I had started, so a cab was now twice as costly and definitely out of the question. As I sat in the cold, exhausted, waiting for the bus to return, I thought ‘One day...I’m going to have my own business. And I’m going to look back on this and smile. But today is not that day.’ However, as I recalled my night’s events to a friend the next day, he said ‘And that’s why you have $10,000 in the bank and I don’t. I would have been in a cab immediately.’

6) I don’t make a ton of money. I don’t make bad money, but I know I make the same or often less than most of my friends. The point- it doesn’t matter what you make, it matters what you do with it. I may have only saved $2 on my return bus ticket or $13 by not taking a cab, but this is all proof that those little things add up. To a lot. $10,000 to be exact

So, how did I do it? That, my friends, is a many-layer explanation.

First, I had to figure out where my money was going.

Luckily for me this was easy. Since I got my first credit card at 18, I have put nearly every purchase on it, and then paid it in full, every single month for 11 years*. This has helped me three fold:

1) Allowed me to build incredible credit (over 800)

There are a lot of factors that go into building good credit, but paying off a card in full every month for a decade has not hurt. As far as I understand, it’s also helped that my limit was extremely high compared to the total I was putting on it. i.e. If you are maxing out cards every month, it can look bad.

*The caveat: I did have a few months here and there (usually while traveling) where this was not going to be possible. I fully admit I dipped into the Bank of Mom for an interest free loan to avoid high CC interest. This is where the majority of my debt came from. Some of it was straight loans for specific things, some was ‘Oh shit, I overspent and suddenly have 28% interest coming my way’. (Also, never get a credit card with interest that high. I changed that very quickly. Negotiation with credit card companies is not that difficult when they think you are going to leave).

2) Earn airline miles.

I have the American AAdvantage World Elite Mastercard, but there are many great ones out there. There are three main airline alliances; miles earned on one airline can be used by the others in the alliance. If you are deciding which card to get, look at where the alliances fly and where you need to go. I earn miles in all three of them, but American is in the OneWorld Alliance which has generally worked well for me. Here’s a great article about comparing the three.

I started with the Bronze card, which only gives you 1 mile per $2 spent, but it had no annual fee. Since I was usually broke, this was great for me. By using this card for everything, I’ve received at least 3 round trip tickets to Europe.

Recently I just opened a platinum version of this card. It is 1 mile per $1 spent (double miles of my other card!) but usually has a $95 annual fee. I jumped on a promo that not only waived this fee for a year, but also had a 50,000 mile sign up bonus. That’s more miles than a RT ticket to Europe. When it comes time to renew for the year, I will either negotiate another year of the fee waived, or I will cancel the card. (Though opening and canceling cards for miles is not advised for a good credit score without knowing what you are doing. Here is a great article- with a more in depth article linked- about how to do that).

3) Always have record of where my money goes

I rarely use cash, which helps in itself. By using cards, I know exactly what I spent, as well as where & when. I first used this information to create my budget, and now use this info to update my budget regularly. I was able to go back on months of purchases and add up just how much I was spending on eating out, groceries, drinks, random crap, etc etc. Though most numbers needed shrinking, it helped me understand how much I should set aside for each category in my new budget.

If you don’t have records like these, it may be helpful to spend a month or two first writing down every single thing you spend to get an idea of where it all goes. My records held nothing of my bad habits back (what did I spend $56 at Target on??), because they were recorded before I decided to be disciplined. But I have a feeling that writing it all down for this project will be like dieting- knowing you have to write it down may make you eat (spend) less in the first place. At least I hear this is how it works...I don’t believe in dieting, as evidenced by my love of carbs and sugar.

How To Make A Budget

So now I knew how much money I spent on stupid stuff. And also on worthwhile stuff, but surely that could be cut down in exchange for a goal. So how to do that?

I know in today’s world, there’s an app for everything. But digitally I’m a pretty old school person. I tried a few apps, and just wasn’t comfortable with them. I’m a firm believer in simply doing what works for you. So I went to digital paper and pencil with a simple Google Spreadsheet.

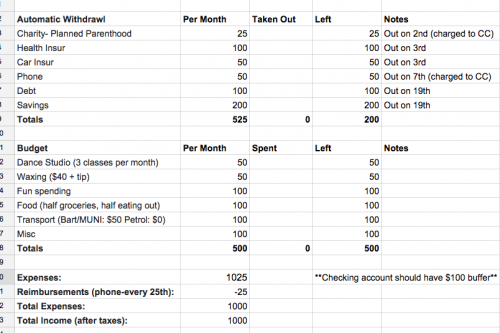

Here is a screenshot of an example budget of mine. Note that for simplicity’s sake I have done this as if the person makes exactly $1000 per month after taxes. You may also notice that there is not a line for rent. No I do not live rent free; this is because my rent is essentially already deducted from my paycheck before I get it. Obviously most people would have this first.

How I Set Mine Up

I essentially worked backwards. I looked at how much I made per month after taxes, and then looked at all my fixed expenses (health insurance, car insurance, etc). I then took what was left and used it for the rest. But here’s where I finally got smart. I finally PAID MYSELF FIRST.Before I could give my money to other people, shops, experiences, I gave it to myself.

I remember first learning this concept in high school(!) yet in over a decade I had never done it, until now. From my past spending records, I had an idea how much I spent on food, etc. For example, if I made $1000 a month, and needed $225 to pay my bills, I had $775 left over. I easily could have spent all of this without trying, and still feel broke. But I wanted to get out of debt and into savings, so that had to change. I scrimped down each category to as low as I thought I could ($525 total) and saw it left me with $300. I could then put this money towards debt *and* savings, at the same time.

I was used to having my bills auto withdrawn, so I did the same for my savings and debt. I get paid twice a month, so I have half withdrawn at the beginning of the month and half later on. If you get paid once a month, I recommend doing this right away. The Notes column shows what dates the money leaves my account. Two of them are actually charged to my credit card instead, as it worked out better that way. Always look into your best options- I found out that if I charged my phone bill to my credit card, it was free, whereas direct withdrawal from my checking account would add a $3 fee.

I played and tweaked with this to get my expenses- including debt and savings payments- to match my total income. I get reimbursed for part of my phone bill for work, so that is accounted for as well. I changed these amounts the first few weeks/months as I saw what was too low or what could be lower.

The spreadsheet has 3 columns: Per Month Total, Taken Out/ Spent, and Left. I have simple formulas so that (Total)- (Out/ Spent) = Left. If my total food budget was $100 for the month, and I spent $15 on a dinner out, I would type that into 'Spent'. 'Left' would automatically update to $85.

Probably the most important thing is that I actually used it. Religiously. (And still do). Here’s an example, with explanation below:

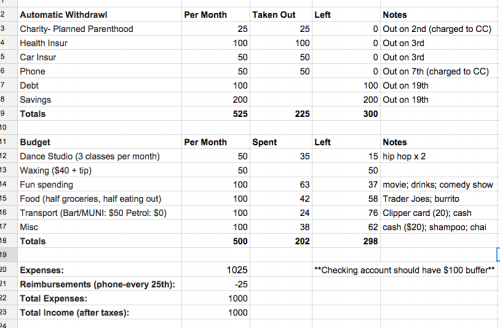

How I Use My Budget

The screenshot above is an example from the 10th of the month. As some of my direct withdrawals were taken out of my account, I would mark that down and the ‘Left’ column would automatically adjust, as explained above. Each time I buy something, I update the spent column totals, which adjusts how much I have left. In this example I have $298 left for the rest of the month. Sometimes I don’t like what it says, and realize I’ve spent way too much money early on in the month. But at least then I know to slow down before I go over and can’t pay my credit card in full.

Though sometimes it's felt very cheap or a bummer to say no to this and that, most of the time I actually feel way less guilty eating out or doing something fun because I've accounted for it. If all my important categories are taken care of, and I have money left, then why not do something fun and fully enjoy it! I thought really hard about what to include/how much.

For example, I cut down my dance classes to 3 per month instead of 3 per week. However I still have a line item for waxing. (Yep, there it is!). This was something that felt frivolous and yet I didn’t want to let it go. So I kept it and adjusted other areas. In the past I would have felt like waxing, pedicures, etc were a waste of money if I am trying to save, but now it’s my monthly girly splurge. I’ve accounted for it, so I get to actually enjoy it.

I also make notes on the side columns of what I spent my money on. This helps me keep track in general, but also helps me to remember where I’ve left off on updating as I look at my CC statement. I usually add a note on the spreadsheet title as well i.e. ‘Budget- Updated 07/10’. As I said earlier, I rarely use cash but sometimes you have to. In this case, I always mark it down that I’ve taken it so I’m not surprised later when suddenly there isn’t enough in my account to cover.

I also keep notes on the side about any reimbursements coming my way. I buy a lot of things for the hostel on my own credit card (airline miles!) and get reimbursed in cash. It’s important to keep track of that as well. I also always keep a $100 buffer in my checking account, just in case.

I first actually made this budget (with much higher numbers than now) several months before I set out on my 2015 goal of saving $10,000. I realized I was getting too old to have debt and absolutely no savings. So I made my budget to start putting away $100 per month. With several months of practice under my belt of sticking to a (pretty loose) budget, it felt more attainable to go for a big goal. It also made it much easier in practice to live by the very strict one I would create in January (which requires putting away $850 per month).

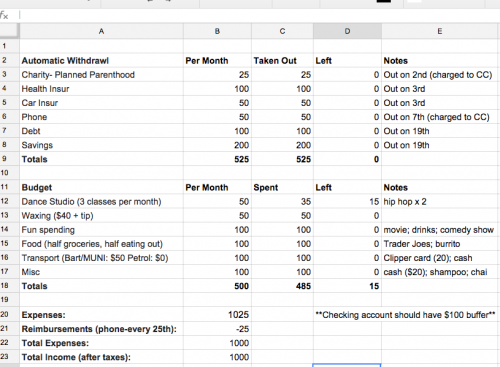

What it looks like end of the month:

Usually, every ‘Left’ column says 0. I’ve got my budget down so tight I squeeze every last penny. BUT, once in awhile I have money left over. In this example, I only took 2 dance classes that month instead of 3. In this case I always transfer anything extra at the end of the month straight to savings, rather than spend it.

One of the biggest reasons I reached my goal so much faster than anticipated is that I’ve always increased my savings, NOT my budget, when receiving anything extra. If I got a raise, my monthly auto withdrawal to savings immediately increased. A bonus was immediately transferred, as was my tax refund. Cash from a focus group- a great way to make extra money!- was set aside for a savings project (i.e. something I wanted but didn’t want to dip into savings for). Would it have been fun to have extra money to splurge? Yes. But I had been living by a budget that didn't include that money and was doing fine. By transferring it right away to savings, my daily life didn't change...but my savings grew even more.

Discipline, Consistency ...and More Discipline!

All of these tools are great, but they don’t work unless you actually use them. And regularly. I pull up my CC statement online and update my budget every 3 or 4 days, so I never have an excuse to not know how much money I have left to spend. It tells me right there. However, like so many things, this turned out to be much more of a mind over matter/ psychological process than anything.

My lifestyle really didn’t change that much. I did end up with extra income from a side job that allowed me to do some fun things I wouldn’t have otherwise been able to (go to a festival, new surfboard, etc). However it’s mostly self control. I am much harder on all of my 'latte factors' (starbucks, eating out, drinks, impulse purchases) since I know I will have to record it and then not have that money for later. That being said- if you are trying to save for something big, I do recommend having a side job if you can. I was very fortunate to find something that is not only lucrative but also something I really care about. (If you’re ever in SF, come learn about the gay rights movement on my Castro Walking Tour!)

One important thing I realized is that having a budget made me actually live cheaply instead of just thinking I was living cheaply. Especially since I've always lived my life on a budget. I was erroneously thinking 'I already choose the cheapest food at the grocery store or the cheapest beer at the bar, so how could I live any cheaper? I get starbucks twice a month, not every day, I can't possibly save anything with my latte factor.'

Buying the cheapest beer at the shop or ordering the cheapest thing on the menu is great, unless you are buying more of it than you actually have money for. I think a lot of people worry, “I’m already living paycheck to paycheck, how could I possibly do any better?” I know everyone's situation is different, but I realized for myself that without a real budget, and strictly following one, I was doing this because I was spending beyond my means, not because I didn’t have enough. I do earn more now than when I first started at this job, but not to the point of how much I’ve saved. I still say ‘no, I’m broke’ all the time in reference to doing things...but now it’s because my savings account is shooting skyward rather than living paycheck to paycheck.

In summary, there is still a long way to go. While I reached my goal much faster, some of that money will disappear again. My car needs brakes, I want to take a trip with my mom in January (hoping for Cuba!), and something always comes up. My goal now is to be within the $15,000 range come December. I also plan to open a Roth IRA and am looking into a couple other options to increase this money even more for the future. It’s not enough to open tomorrow, but as someone who has always wanted my own business but never thought I'd have money to do it, this feels pretty amazing. Thanks for reading, feel free to email me or comment with questions, and thanks for the support!!

[For those that just want the brief breakdown]

How I Did It- the mini version

- Figured out where my money went

- Always used a credit card

- Paid in full every month to earn great credit

- Earned airline miles

- Always had a record of where my money went

- Made a simple budget

- Looked at my CC records for spending habits

- Total-Spent-Left columns

- Auto withdrew all of my bills right after being paid

- Auto withdrew money to both debt and savings after being paid

- Updated this budget every 3-4 days

- Was disciplined as can be

- Always added to my savings not my budget with extra money

- Took a side job to have money for fun things

- Always took the cheap or free option, even if less convenient

Saved $10,000 in 6 months!

Any thoughts, questions, or comments? Sign in and comment below!

**I know many of you comment on these blogs on the site's FB page, which is great, but it would be even better to have the comments directly on here for everyone to read. Thanks for your input and helping to further our knowledge!**

In case you missed it:

<< My last post: Adding Bars & Restaurants: Extra Value or Extra Headache?

>> My next post: The Roadblock to Efficiency: My Worst Time Wasters

Just joining the show and don't know who I am? Check out my introductory blog post.

As always, send any suggestions, questions, or thoughts on the blog my way by emailing me here.

Peace & love,

Courtney

P.S. Don't miss out! Follow HostelManagement on Twitter if you would like to receive updates when new my blog posts are made.

Key image courtesy of Flickr.